SmallCap Round-Up: A Brace Of Bargains

Alumasc Group (LON:ALU) – Unwarranted Discount To Its Peers

The sustainable building products group yesterday reported its results for the six months to end December last year.

Group revenues were up 5% at £45.0m (£42.6m), while underlying pre-tax profits were £5.6m (£6.3m), pulling earnings back to 12.3p (14.1p), with its dividend up fractionally at 3.40p (3.35p) per share.

Building Envelope and Housebuilding Products both showed strong first half performances and is witnessing good momentum going into the second half.

Water Management saw lower first half export volumes, but a stronger performance is expected in this half year as project phasing comes through.

CEO Paul Hooper stated that:

“This was a strong first half performance, against a comparative that included significant sales to Chek Lap Kok airport in Hong Kong. While the short-term market remains uncertain, we enter the second half with encouraging momentum and a record half year order book, which includes the next phase of the Chek Lap Kok project, giving us confidence in the delivery of our expectations for the full year.”

After the interim results analyst David Buxton, at brokers finnCap, has retained his Buy rating on the group’s shares, keeping his 315p a share price objective.

His estimates for the full year to end June 2023 are for £91.0m (£89.4m) sales and adjusted pre-tax profits slightly lower at £11.3m (£12.7m), with earnings of 24.2p (28.2p) but increasing its dividends to 10.3p (10.0p) per share.

He sees better times in the coming year, with £96.0m revenues and £12.0m profits, worth 25.7p in earnings and with an increasing dividend of 10.8p per share.

He considers that the group’s shares remain at an unwarranted 42% discount to its sector peers.

A year ago this group’s shares were trading at around the 225p level.

After hitting 169p in the market after the results news, before dipping to 157p, the shares closed fairly steady at 160p last night.

At that level I rate the shares as a good medium-term hold, looking for them to pick up over the 200p level fairly soon.

(Profile 13.02.20 @ 116p set a Target Price of 145p*)

(Profile 08.06.20 @ 80p set a Target Price of 105p*)

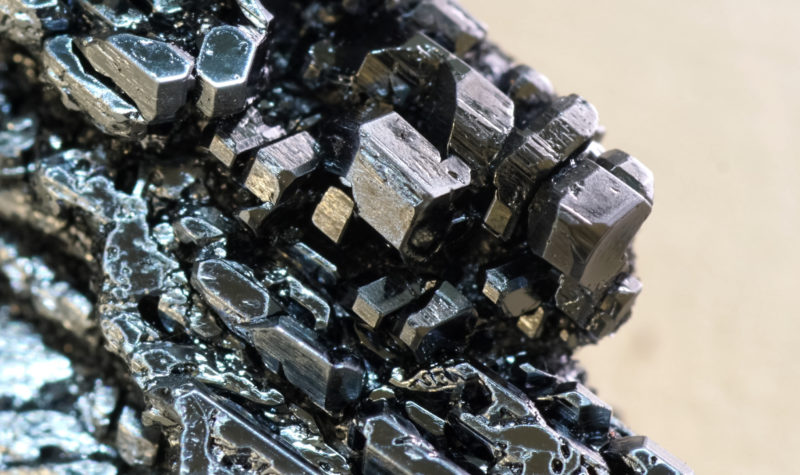

Iofina (LON:IOF) – Robust Demand Backs Margin Improved Results For 2022

The latest Trading Update from this iodine specialist, which covers the full year to end December 2022, was very positive.

Ahead of the full year’s figures being announced in May, the £53m capitalised group updated shareholders that its 2022 EBITDA figures would be materially ahead of market expectations.

Global demand for iodine and iodine-based derivative products were strong throughout the whole of last year.

That combined with improved production and higher pricing, resulted in better sales margins.

Furthermore, iodine prices have remained steady into Q1 2023 and the group continues to see robust demand for its iodine and iodine derivatives.

CEO Dr Tom Becker stated that:

“2022 was a year of significant progress for Iofina. Solid iodine production performance, higher prices and strong demand for iodine, and the beginning of construction of our newest plant IO#9 are all examples of the positive momentum that the Company is carrying forward into 2023.

The Board now expects 2022 EBITDA to exceed market estimates and we look forward to releasing the Company’s fully audited 2022 results in May.

We are excited for the commencement of production at our IO#9 plant later in Q2 2023 which is anticipated to produce 100-150MT of crystalline iodine per annum.“

Analyst Alex Brooks at Canaccord Genuity Capital Markets rates the group’s shares as a Buy, having increased his price objective by 2.5p to 37.5p on the news.

He estimates $42.5m ($39.0m) sales for the last year, with EBITDA rising to $11.0m ($6.9m), taking earnings up to 3.4c (2.5c) per share.

For the year now underway he looks for $45.3m revenues, $11.7m EBITDA and earnings of 3.7c per share.

Former fund manager Richard Sneller was certainly shrewd as he picked up more stock in the group in late December last year. Now with the biggest holding, almost 35m shares representing 18.2% of the Iofina equity, he will benefit from the group’s shares rising to Canaccord’s price objective.

Hold very tight, they are heading higher still – they closed last night at 28.05p.

(Profile 29.07.20 @ 13.5p set a Target Price of 18p*)

(Asterisks * denote that Target Prices have been achieved Profile publication)

Alumasc

Sold or pulled out of buisness where customers were asking for design and implementation. Only wants to do design.

Results overview ….

Key Financial Results

Revenue: UK£45.0m (up 5.4% from 1H 2022). But less than inflation. For me stagnant.

Net income: UK£4.49m (down 8.8% from 1H 2022).

Profit margin: 10.0% (down from 12% in 1H 2022). The decrease driven by higher expenses.

EPS: UK£0.13 (down from UK£0.14 in 1H 2022).

And the debt load which will be more expensive with increasing borrowing rates.

No idea how you rate this a bargain.

Much better elsewhere imo